ny mortgage refinance transfer taxes

On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender. 50000 x 18 900.

My Dad Passed Away And I Ve Been Paying His Mortgage How Can I Get The Loan Put In My Name Fox Business

The New York State transfer tax rate is.

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

. The rate is broken down into the state and local portions. Calculating the Mortgage Recording Tax Rate. Special Offers Just a Click Away.

If you borrow more than 500000 you pay 1925 percent. The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender typically pays. You can make sure the seller understands that they will likewise be saving for them as well because they will have reduced New York State transfer taxes which are typically.

In NYC this tax ranges from 18 1925 of the. Thats 1353750 in savings. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

New York State also applies a 04 transfer tax on all properties. The tax must be paid again when. Ad Compare for the Best Home Refinance that Suits Your Needs with the Lowest Rates.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. 50000 x 18 900. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

The rate is highest in New York City where borrowers pay 18 percent of the loan. Properties of up to 500000. 18th May 2010 0533 am.

Yes the CEMA process allows you to only pay the mortgage tax on the new money. 750000 X 1925 1443750. Taxes generally paid by the buyerborrower are due when the.

Along with the state tax New York City Yonkers and several counties apply an additional local tax on recording a mortgage. The New York City. Ad Our technology will match you with the best refi lenders at low rates and no cost options.

For conveyances of real property located outside New York City file Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of. The New York State transfer tax rate is. New York City transfer tax.

Recorded Mortgage on Full Refinanced Amount. 5 rows New York State also applies a 04 transfer tax on all properties. Over 15 million customers served since 2005.

A Rating with BBB. This rate varies by county with the minimum being 105 percent of the loan. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

In a refinance transaction where. Additionally in 2019 NYS imposed an additional 025 transfer tax on all properties above 3 million. So if you borrow 500000 or less you pay 18 percent of the loan as a tax.

Ad Were Americas 1 Online Lender. New York charges a NYS mortgage tax or specifically a recording tax on any new mortgage debt. The rate varies by county with the minimum being 105 percent of the loan amount.

In NYC this tax ranges from 18 1925 of. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Both of these figures include a 05. Learn Your Refinance Options Today.

Heritus Mortgage Live Transfers Mortgage Loan Company Mortgage Loan Officer

Mortgage Brokering In Ontario Cheat Sheet By Utkarsh121 Download Free From Cheatography Cheatography Com Cheat Sheets For Every Occasion

Reducing Refinancing Expenses The New York Times

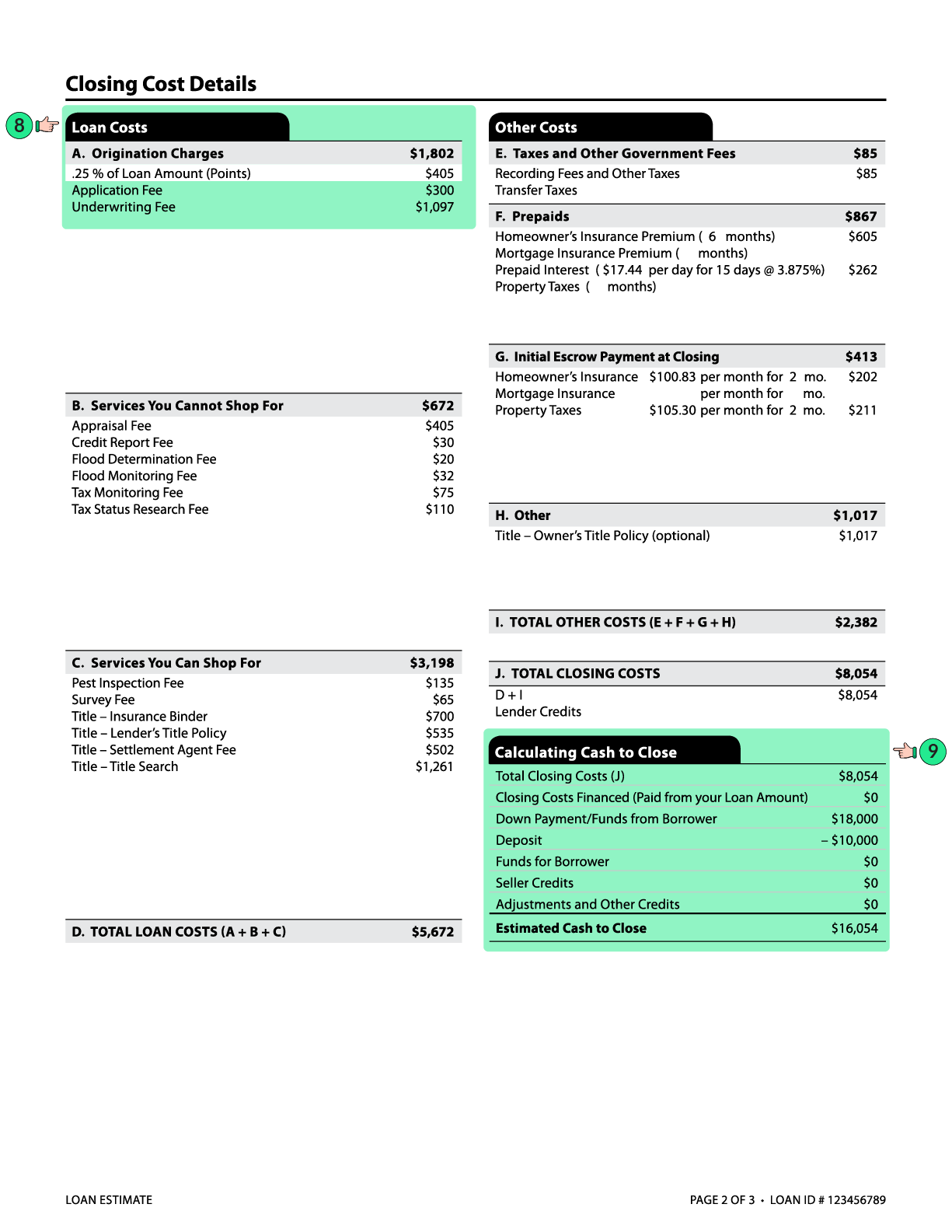

What Is A Loan Estimate How To Read And What To Look For

How To Read A Monthly Mortgage Statement Lendingtree

Porting Assuming Or Breaking A Mortgage What You Need To Know

Can I Lower My Mortgage Rate Without Refinancing Lendingtree

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

Home 8twelve Mortgage Mortgage Financing

What Is A Loan Estimate How To Read And What To Look For

Mortgage Document Checklist What You Need Before Applying For A Mortgage

How To Get Out Of A Reverse Mortgage Lendingtree

/balloon-loans-315594-cadd06e3bbe046d39311cd4be59d794c.gif)

How Balloon Loans Work 3 Ways To Make The Payment

/dotdash-INV-final-How-Refinancing-a-Mortgage-Affects-Your-Net-Worth-May-2021-01-d85de4e0cbed4b5db0aa181e5000f8d8.jpg)

How Refinancing A Mortgage Affects Your Net Worth

/dotdash-INV-final-How-Refinancing-a-Mortgage-Affects-Your-Net-Worth-May-2021-01-d85de4e0cbed4b5db0aa181e5000f8d8.jpg)

How Refinancing A Mortgage Affects Your Net Worth

Mortgage Interest Rates Slide Again To A Brand New Record Low

Refinancing Your House How A Cema Mortgage Can Help