do you pay taxes when you sell a car in illinois

To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transactions Form VSD 190 to the IL SOS in person. However you do not pay that tax to the car dealer or individual selling the car.

What S The Car Sales Tax In Each State Find The Best Car Price

REPLACEMENT VEHICLE TAX If you are a selling dealer in Illinois and the buyers address is in Illinois for title and registration purposes you are responsible for filing the ST-556 tax return and paying the sales tax due.

. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Selling a vehicle for a profit is considered a capital gain by the IRS so it does need to be reported on your tax return.

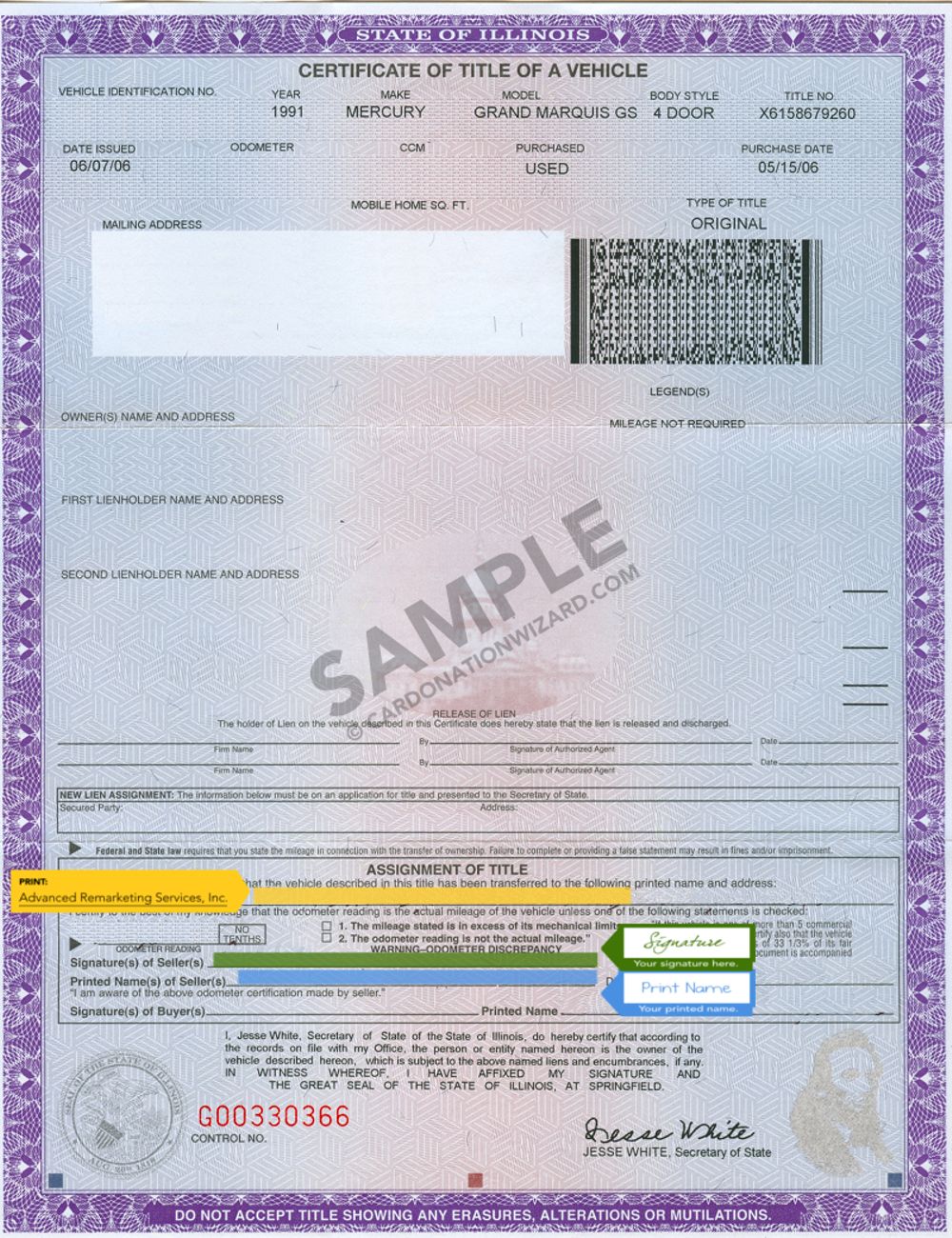

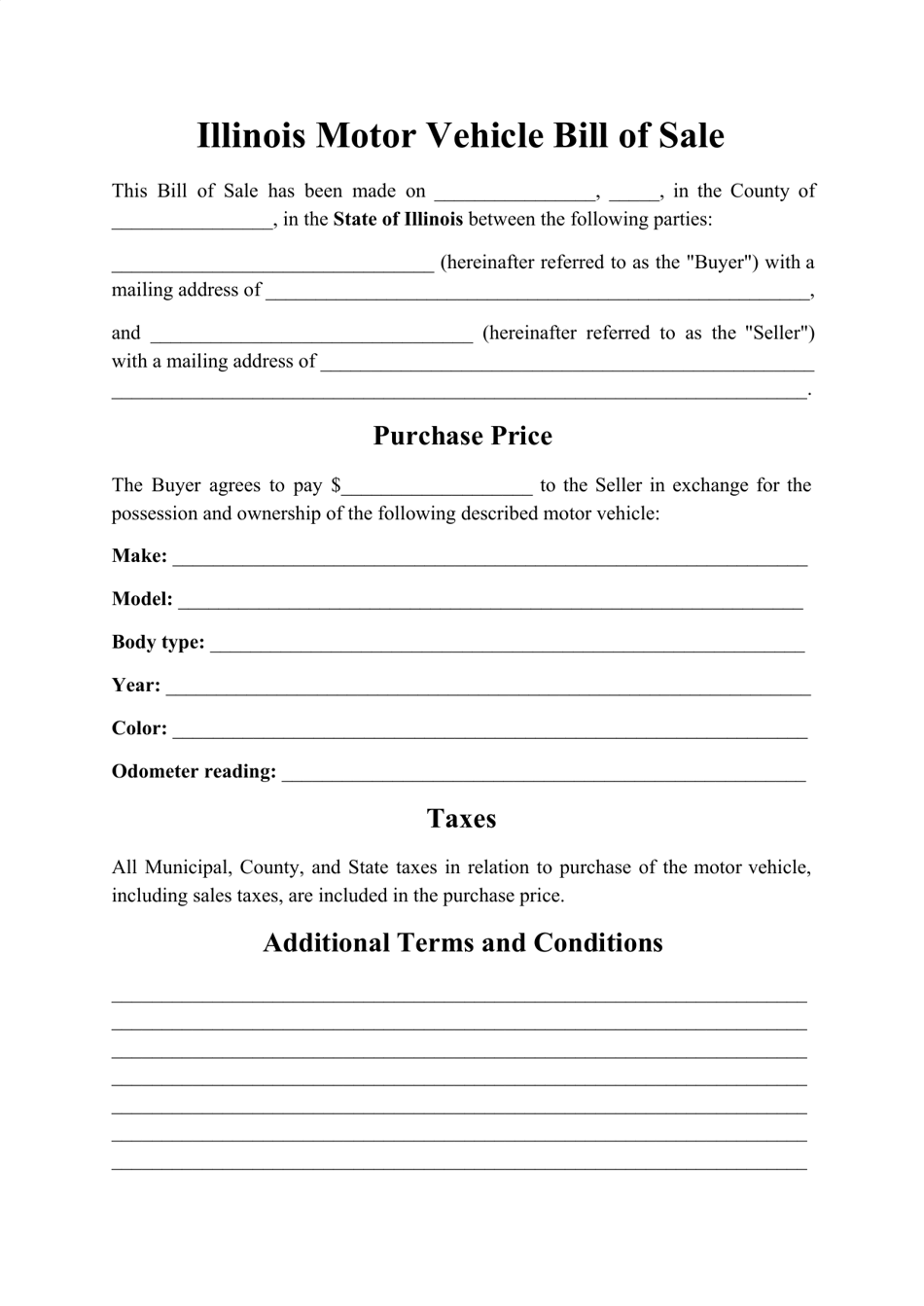

You should attach a copy of the bill of sale as proof of. Selling a car for more than you have invested in it is considered a capital gain. Selling a car for a profit If you sold your vehicle for more than what you purchased it for the story is different because you must pay taxes.

You will pay it to your states DMV when you register the vehicle. When you sell a car for more than it is worth you do have to pay taxes. You typically have to pay taxes on a car received as a gift in Illinois.

The answer to this question is no you do not have to pay taxes on the sale of your vehicle unless of course you actually sell your car for more than what its worth or more than the vehicles original purchase price. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. What is the Sales Tax on a Car in Illinois.

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. If you want to prevent your daughter from potentially facing a large sales tax bill consider gifting a. Income Tax Liability When Selling Your Used Car.

You will need Form RUT-50 to report the gift. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Illinois private party vehicle use tax is based on the purchase price or fair market value of the motor vehicle with exceptions noted on the right ie for motorcycles and specific situations.

However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000. There is also between a 025 and 075 when it comes to county tax. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

Thus you have to pay capital gains tax on this transaction. If you are an Illinois dealer making a courtesy delivery on behalf of an out-of-state selling dealer you are not responsible for reporting the sale on your ST-556 return. The amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you live in.

If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Gifting the car and she will need to pay sales tax on the cars actual market value.

Sometimes even if you sell the car for a little more than its actual value you dont have to pay tax for it. The purchase price of a vehicle is the value given whether received in money. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

When you sell your car you must declare the actual selling purchase price. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. If you sell it for less than the original purchase price its considered a capital loss.

This means you do not have to report it on your tax return. If the selling price is 15000 or more the tax is based on the selling price of the vehicle. You should attach a copy of the bill of sale as proof of the purchase price.

Do you have to pay tax if you sell a car. For most purchases you will use Table A or B to determine the tax amount. You can sell your daughter a car for 1 if you want but you dont save much work vs.

In addition to state and county tax the City of Chicago has a 125 sales tax. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the vehicle into Illinois. It starts at 390 for a one-year old vehicle.

The amount of capital gains tax you will have to pay may vary depending on numerous variables especially how much income you have from other sources. You have to pay a use tax when you purchase a car in a private sale in Illinois. In this case the buyer must file Form RUT-25 Use Tax Transaction Return and pay any use tax due.

Then the difference is. Heres a vehicle use tax chart. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

The supplier reseller who makes the courtesy delivery is not responsible for the declaration of the sale. The tax rate is based on the purchase price or fair market value of the car. However if you sell it for a profit higher than the original purchase price or what is.

There also may be a documentary fee of 166 dollars at some dealerships. What most owners dont know is that in many cases a vehicle is considered to be a capital loss which means that the owner. The taxes can be different in the case of a.

Thats 2025 per 1000. Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales. Do you have to pay taxes on a car thats a gift in Illinois.

You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. This tax is paid directly to the Illinois Department of Revenue.

Free Illinois Bill Of Sale Form Pdf Word Template Legaltemplates

How Do I Sell My Car Illinois Legal Aid Online

Notice Sales Tax On Trade Ins Changes January 1 2020 Under Senate Bill 690 Signed June 28 By Gov J B Pritzker State And Lo Car Illinois Trade In Value

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale Bill Of Sale Template Template Printable Private Party

What Is Illinois Car Sales Tax

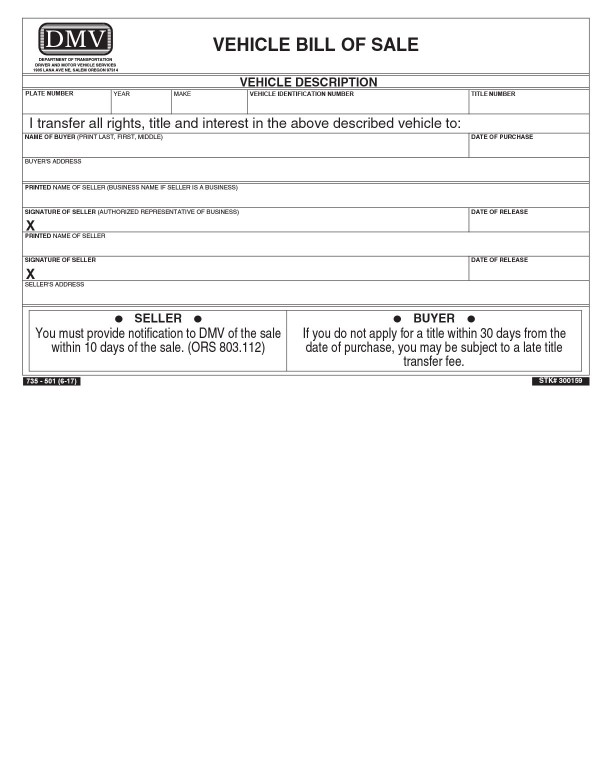

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Free Illinois Bill Of Sale Forms Pdf

Gifting A Car In Illinois Getjerry Com

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

Illinois Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Which U S States Charge Property Taxes For Cars Mansion Global

Illinois Used Car Taxes And Fees

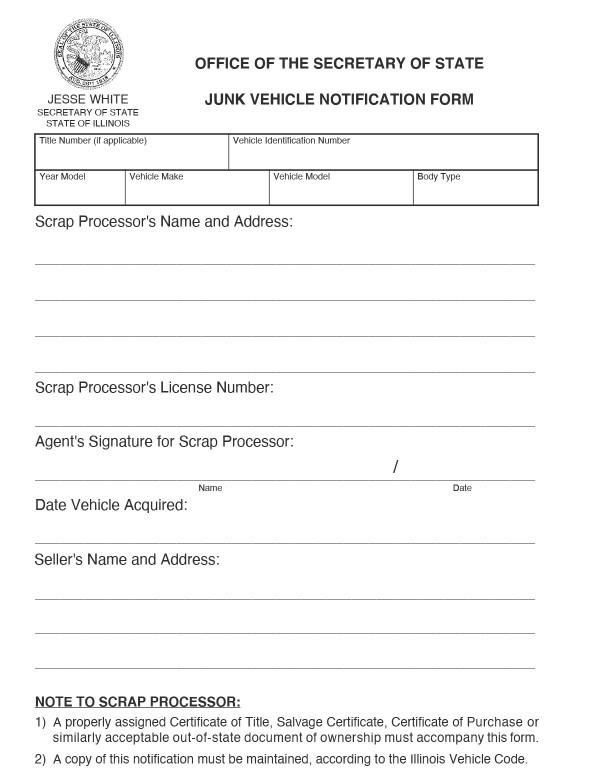

Illinois Bill Of Sale Forms And Registration Requirements

Buying From A Private Seller Vehicle Registration Titling And Fees Explained